Final FLSA Overtime Rule: Guidance for Non-Profit Employers and Board Members

You likely received notice that the U.S. Department of Labor released its final overtime regulations on May 18. Many non-profits will now be required to take steps to revise their pay practices and work distribution. This poses difficulties for non-profits of all sizes, including those that are funded by government grants and contracts, as well as those with limited staff. Whether you are the executive director of a non-profit or serve as a board member, we hope you find the below information helpful in analyzing how your organization will be affected.

You likely received notice that the U.S. Department of Labor released its final overtime regulations on May 18. Many non-profits will now be required to take steps to revise their pay practices and work distribution. This poses difficulties for non-profits of all sizes, including those that are funded by government grants and contracts, as well as those with limited staff. Whether you are the executive director of a non-profit or serve as a board member, we hope you find the below information helpful in analyzing how your organization will be affected.

Step 1: Does this new FLSA salary minimum even apply to my organization?

Yes. While many organizations may argue they do not have annual revenues (volume of sales or business) of over $500,000, that, in and of itself, is insufficient to conclude that your organization is not covered by the FLSA. First, if you have employees who regularly: 1) make out of state phone calls; 2) receive or send interstate mail or e-mails; 3) order or receive goods from out-of-state suppliers; or 4) handle credit card transactions, the FLSA new salary-level minimum is likely applicable. Second, state law matters! As an example, if you are a Maine non-profit, Maine's overtime law applies to all employers regardless of their non-profit status and requires that professional, administrative, and executive employees make 3,000 times the State minimum wage or the annualized rate established by the U.S. DOL, whichever is higher in amount. In the current situation, that would mean that the $47,476 salary minimum is applicable. While the DOL has hinted it will not focus enforcement efforts on smaller non-profits, this does not limit individual employee actions.

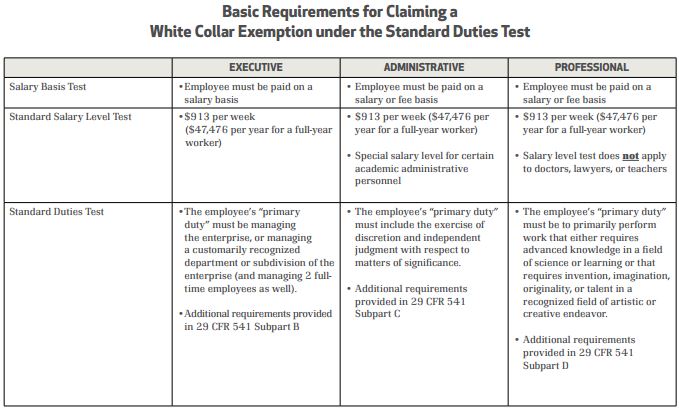

Step 2: Is the individual properly classified?

Click on the image to view full size.

Click on the image to view full size.

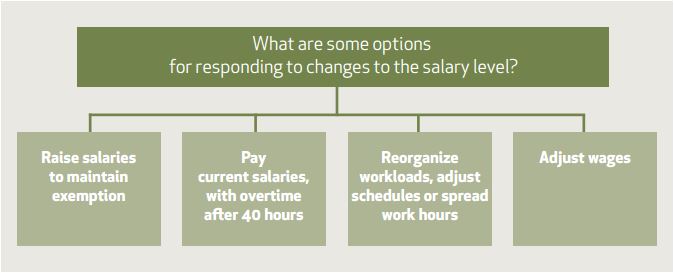

Step 3: How can I respond?

Verrill Dana is here to discuss multiple ways in which non-profits can respond to the recent changes. The DOL has set forth some options in published communications, but there may be others depending on the type of work you are performing and the individuals who are performing the services. Contact a member of Verrill Dana's Labor & Employment Practice Group to discuss more.

Click on the image to view full size.

Click on the image to view full size.

*All charts obtained from DOL Guidance for Non-Profit Organizations on Paying Overtime under the Fair Labor Standards Act.