No Longer a Walk in The Park - Entity Formation Under the Corporate Transparency Act (Updated)

Presently, forming a corporation, LLC or other entity in the U.S. can be done on a largely anonymous basis, without naming its owners and with only limited disclosures about managers, officers and directors. Under the Corporate Transparency Act and related rules, all that is about to change. These rules impose sweeping new ownership reporting requirements on most entities (whether now existing or to be formed) in the name of combatting money laundering and other financial crimes.

IMPORTANT TERMS.

Reporting Company – All U.S. entities formed as corporations, LLCs, limited partnerships and the like are presumed to be “Reporting Companies” under the Act unless exempt or excluded. As further discussed below, established companies that have more than 20 full-time U.S. employees and more than $5 million in reported revenues are generally exempt, as are government entities and various regulated entities. Trusts and general partnerships, too, generally are excluded from the definition of Reporting Company. Most non-U.S. entities that do significant business in one or more States will also be Reporting Companies.

Beneficial Owners – Each Reporting Company must report the identity of various individuals who are deemed its “Beneficial Owners”:

- Each “senior officer” (as defined) and most every director

- Every other individual who (directly or indirectly) has “substantial influence” over one or more important decisions of the Reporting Company, such as amendments of governance documents or the compensation of senior officers

- Every individual who (directly or indirectly) owns or controls at least a 25% voting or equity interest in the Reporting Company, with a limited exception for purely passive owners who hold their interests solely through exempt entities[1]

BOI Report – A report required to be filed online with FinCEN (a bureau of the Treasury Department), which sets out for the entity:

- full legal name and any trade name or d/b/a name;

- principal address of the entity;

- the jurisdiction of its formation, and

- its federal taxpayer ID number.

The report must also set forth certain personally identifiable information (PII) about each Beneficial Owner of the entity, as follows:

- Full legal name (including middle name and suffix, where applicable)

- Date of birth

- Current residential street address (not a post office box or a business address)

- Unique identifying number from any of the following non-expired governmentally issued ID documents: U.S. passport; driver’s license; or foreign passport (be used if the person has none of the approved domestic ID documents)

- An image of the non-expired ID document showing the unique identifying number being used.

This sensitive information will be made available to law enforcement and to financial institutions, but is otherwise not accessible to the public and not subject to requests under the Freedom of Information Act. Companies that collect PII from Beneficial Owners should take steps to protect this information from unauthorized disclosure.

Company Applicants – Except for entities formed (or in the case of foreign entities, first qualified) before January 1, 2024, the BOI Report of the Reporting Company must also identify up to two individuals who filed the documents to form the entity. These are known as the entity’s “Company Applicants.” The BOI report must contain the equivalent PII for the Company Applicants, except that if they work for a law firm or other business that forms entities, a business address may be provided in lieu of residence addresses.

FinCEN Identifier – In lieu of providing the required PII to the Reporting Company, a Beneficial Owner or Company Applicant may instead provide a FinCEN Identifier number. The FINCEN Identifier application contains the same PII as would appear in a BOI Report. Use of a FinCEN Identifier avoids the Reporting Company having to collect and store (and protect) the PII, and avoids requiring the covered individual entrusting PII to the Reporting Company[2]

***

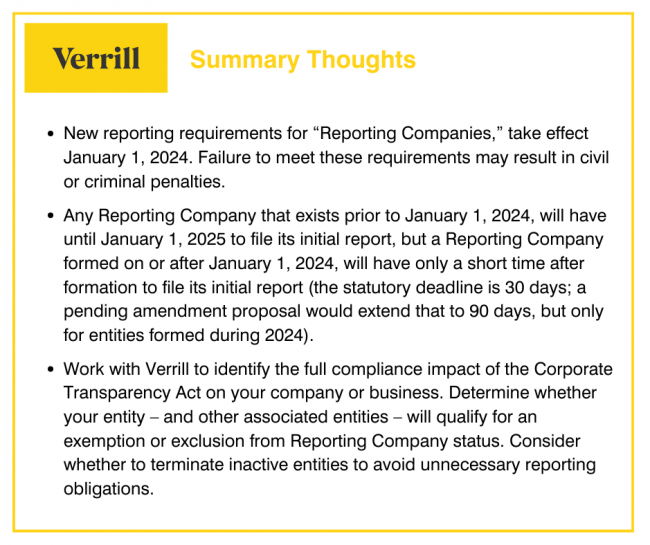

ENTITIES ALREADY EXISTING IN 2023. Except for exempt entities and excluded entities (discussed below), all existing entities already formed or qualified in the U.S. (as well as new entities formed before the end of 2023) will be Reporting Companies covered by the CTA reporting rules and must file BOI Reports by January 1, 2025.[3] In anticipation of the CTA’s implementation, we encourage all clients to evaluate their compliance plans. For instance, you should consider beginning the process of compiling reporting information; adopting policies requiring officers, directors, and investors to furnish required information (or a valid FinCEN Identified) to the Reporting Company; and creating a system by which all changes to reported information are tracked and updated.

UPDATE REQUIREMENTS. A particularly onerous aspect of the CTA reporting regime is that as soon as any required information on a BOI Report changes (or is discovered to have been inaccurate when filed), the Reporting Company has just 30 days to file an update. This means that Reporting Companies must continuously be alert to changes in their reported BOI data; so a strong compliance plan will help avoid problems.

COMPLIANCE NOTE. Review the existing companies affiliated with you. To the extent that you have inactive companies that can be terminated, doing so may avoid having to file a BOI Report for them.

EXEMPT ENTITIES. Statistically, the vast majority of companies in the U.S. will qualify as “Reporting Companies” and thus will need to file BOI Reports. The CTA does, however, exempt many classes of companies on the theory that these pose lesser risk in terms of money laundering and other financial crimes monitored by FinCEN. The exempt entities include:

- Banks and bank holding companies, SEC-registered broker-dealers and investment advisers, SEC-registered mutual funds and other investment companies, SEC-reporting venture capital fund advisers, and certain other categories of government-regulated entities

- Venture capital funds or other pooled investment vehicles if operated or advised by an already-regulated entity referenced above

- SEC-reporting public companies

- Any entity that (i) has more than 20 full-time employees in the U.S., (ii) regularly conducts business at a physical location in the U.S., (iii) filed a federal income tax return for the previous year, and (iv) reported on that tax return more than $5 million in U.S. gross receipts/sales (net of returns and allowances) for that previous year on a consolidated basis (these entities are referred to in this article as “Exempt Larger Companies”)[4]

- Most tax-exempt organizations and charitable trusts

- Most tax-exempt political organizations

- Governmental authorities or entities.

Importantly, the list of exempt entities also includes wholly-owned subsidiaries of most of these exempt entities, including those of public companies and Exempt Larger Companies.

EXCLUDED ENTITIES. Domestic trusts and general partnerships that are created by operation of law without the filing of a formation document with a secretary of state (or similar office) under the law of a State are excluded from having to file BOI Reports. Sole proprietorships are excluded if no entity is formed. Foreign companies are excluded, unless and until they register to do business in the U.S. by filing a document with a secretary of state (or similar office) under the law of a State or Indian tribe.

A company’s status as an exempt or excluded entity does not mean that it can ignore the CTA. If an exempt/excluded entity holds any investment in a Reporting Company, information about its key individuals may need to be collected and reported by the Reporting Company if the exempt/excluded company

- has a representative on the Reporting Company’s board or

- has approval or veto rights that give rise to “significant influence” over one or more important decisions of the Reporting Company or

- owns or controls at least a 25% voting or equity stake.[5]

NEW U.S. ENTITIES FORMED AFTER 2023. Starting January 1, 2024, nearly every new domestic entity must file a BOI Report within 30 days after its initial formation date. Note that FinCEN has proposed extending the time for filing the BOI Report for entities formed after 1/1/24 and before 1/1/25 to 90 days.

FOREIGN ENTITIES. The CTA rules reach foreign entities if they register to do business in the U.S. The trigger point for them is not formation, but rather the date of first filing with a State for qualification to do business. Similar to domestic entities, a foreign entity that first qualifies after 2023 is treated like a new entity and needs to submit a BOI Report within 30 days after its initial qualification filing date. A foreign entity that is already qualified (or qualifies by the end of 2023) has until January 1, 2025 to file its initial BOI Report. The determination of covered individuals follows the same rules as for domestic entities, and the fact that an individual resides outside the U.S. will not excuse the Reporting Company from including required PII for that individual.

PENALTIES. Violations of the reporting obligations can be met with civil penalties of up to $500 per day and criminal penalties in the form of a fine of up to $10,000 and prison sentences of up to two years, or both. Generally for criminal penalties to be imposed, violations must be willful.

FINCEN PUBLICATIONS. On Sept. 18, 2023, FinCEN published a Small Entity Compliance Guide to assist entities in complying with BOI reporting requirements. The Compliance Guide addresses, among other things, (i) which entities are “Reporting Companies” and must file BOI Reports (and which are exempt); (ii) who is a “Beneficial Owner” (and who is not); (iii) who is a “Company Applicant”; (iv) what information must be reported; (v) what to do if there are changes or inaccuracies in any previously reported BOI data; and (vi) when and how must Reporting Companies file their initial BOI Reports.

FinCEN also has been updating its BOI Reporting FAQs with additional guidance on the scope of the reporting requirements. https://www.fincen.gov/boi-faqs

[1] See Note 5 below for a further discussion of this exception.

[2] Holders of an Identifier number are obligated to update their application within 30 days after any required PII contained in the application becomes stale (such as though an address change or the expiration of the government-issued ID document).

[3] Even an inactive entity will not escape having to file a BOI Report unless it (i) was already in existence on January 1, 2020, (ii) holds no assets (including ownership interests in other companies), (iii) during the previous 12-month period neither sent nor received more than $1,000 of funds, whether directly or through a bank account or other financial account, (iv) has no non-U.S. owners, and (v) has not experienced any change in ownership during the preceding 12 months.

[4] Note that the Exempt Larger Companies category will exclude many existing companies. However, newly formed entities cannot qualify for this particular exemption – regardless of employee count – until they have filed a prior year tax return reporting at least $5 million in gross receipts. Once all qualifying conditions are met, the company will need to update its prior BOI Report to show its newly acquired exempt status.

[5] If an individual is a 25+% owner of a Reporting Company solely due to passive ownership in an exempt entity (such as a limited partner in a venture capital fund), the Reporting Company may elect to report the name of the exempt entity instead of the name and other PII of the underlying individual. This narrow exception does not apply to passive owners of a trust or other excluded entity, and does not apply if the individual is a senior officer.